Non-Sponsored Coverage of Rain Enhancement Technologies, Inc*

Monday September 9, 2025

RAIN

RAIN Enhancement tech

(NASDAQ: RAIN)

Finding small-cap swing trades under $10 isn’t easy.

Thousands of stocks move every day — so how do you narrow it down?

Simple: Catalyst. Technicals. Volume.

That’s the framework I use in my trading, and this morning I think I’ve spotted momentum in RAIN before it happens.

📌 Catalyst

A few weeks back, RAIN was notified by NASDAQ that its market cap needs to increase.

Just last week, the company confirmed they’re working on it.

👉 Translation: management is motivated to move the stock higher.

That’s a clear catalyst.

When a company signals it needs to boost price, traders should pay attention.

📈 Technical Analysis

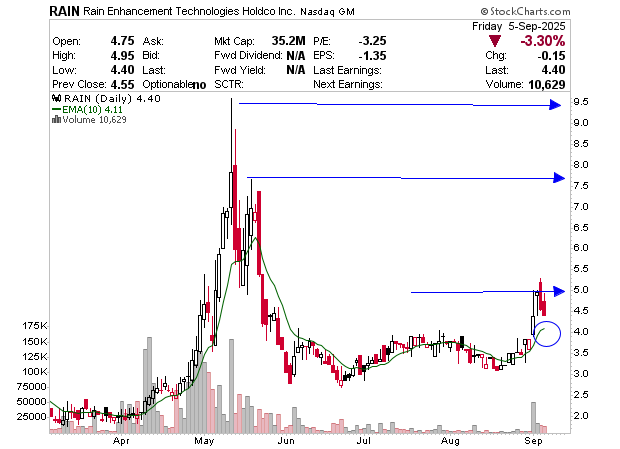

Daily Chart:

Big pivot point at $5.

Range stretches to $10.

With shares trading in the upper $4’s, that’s nearly double potential.

My rule of thumb: grab 20-30% within the range, get in, get out, get paid.

If price dips lower, the 10-day EMA (green line) is my rough stop.

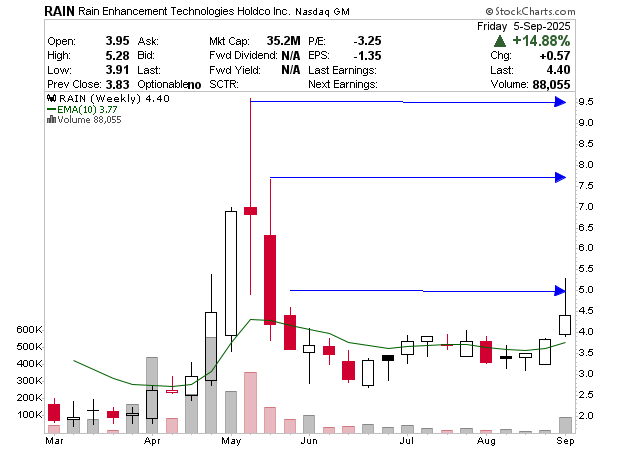

Weekly Chart:

Look at the strong bounce earlier this spring.

Notice the bullish engulfing candle far right — above the 10-day EMA, closing near the highs.

Light volume too, which makes any future surge even more explosive if buyers show up.

Bottom line: the setup looks coiled and ready.

🔊 Volume

We know the company wants the stock up. That usually means news is coming. News brings volume.

And with RAIN’s tiny float, volume can ignite fast. By the time the herd sees it, it could already be gone.

That’s why I’m watching $5 closely.

🎯 Trade Plan I Like

Buy Zone: $4.60 – $5.20

Target: $6 – $7.50

Stop: $4.40’s

Catalyst? ✅

Technical setup? ✅

Volume? Likely incoming. ✅

One note: premarket spreads are wide. That’s normal on small caps. I usually bid the upper $4’s rather than chase. The only time I’ll hit the ask is when a stock is already ripping and spread risk doesn’t matter.

⚡ Bottom Line

Keep RAIN on your radar — I think it’s about to run.

For my full small-cap watchlist (all under $10) and real-time trade alerts sent straight to your phone, subscribe today.

— Jason Bond

– Jason Bond

*DISCLAIMER: This entity is owned by Jason Bond LLC (JB). To more fully understand any JB subscription, website, application or other service, please review our full disclaimer located at https://www.jasonbondpicks.com/disclaimer

Just so you know, what you’re reading is curated content for which we have received a monetary fee (detailed below) to create and distribute. Let’s be clear that investing can be quite the roller coaster as stock prices can have wild swings up and down, so consider those crucial risks before you ever consider trading anything we discuss. Make sure you check out our full disclosure down below for the details on how we were paid, the risks, and why these results aren’t what you’d call “typical.”

Just a quick heads up about this ad you’re reading—as we’ve said, even though we like the company referenced above, and all the facts we discussed above are true to the best of our knowledge, we are running a business here. As mentioned above, this is non-sponsored coverage of RAIN, however, may also buy or sell shares in the company at some point in the future, although neither JB nor its owners own any shares of the company at this time. Also, keep in mind that due to the sheer size of our audience, if even a small percentage of people decide they want to buy this stock, it could potentially boost interest enough to hike up those share prices and cause a temporary spike, and the opposite is possible as our program ends, though that is not always the case.

Now, diving right into RAIN might sound exciting. But remember, it’s like venturing into the wilderness—be aware that there’s exceptional risk involved in trading. This isn’t small potatoes we’re talking about; you could lose every dime you put in, so always carefully think about what you’re doing. That’s why they call this trading, after all. We’re shining a light on the good stuff about the company here, but it’s on you to do your homework, make your own calls, and determine a plan for your own trading, hopefully with the help of your professional 1nvestment advis0r.

Oh, that brings us to another crucial point—we’re not here to tell you (or even recommend) what you should do with your hard-earned money. We’re simply sharing our non-expert thoughts by highlighting some companies we like that could use some help telling their story to more people. We’re obviously biased in our writing. We’re not here to dig into anything that may be negative about the company; this is advertising, after all! Also, keep in mind that if we make some predictions about the future, these are technically known as “forward-L00king statements” under the securities acts, so take those with a grain of salt. As with all forecasts, they’re not set in stone, often wrong, and we certainly can’t know where the Company’s earnings, business, or share price will be tomorrow or a year from now.

Everything you read from us is all for your education, information, and possible entertainment. While we believe the info is reliable and accurate, we can’t wear a cape and guarantee it. Before you jump into anything, make sure to talk it over with a pro—someone you trust who’s licensed to give you real advice. To be clear, neither JB nor its owners, employees, or independent contractors are registered as a secur1ties br0ker-dealer, br0ker, 1nvestment advis0r (IA), or IA rep’s with the SEC, any state securities regulat0ry authority, or any self-regulat0ry organization.

So, that’s the scoop! If you’re intrigued and want to learn more about the companies we talk about, hit up the SEC’s website to dig into their filings and see the full pictur

Get LIVE Commentary On Our Hottest Trades!