Over +$5,500 profit realized Wednesday closing NEON +6% +$3,700 and half YOD +7% +$1,725. My performance in 2014 is +45% +$80,599 with a goal of +133% +$240,000.

Congratulations to Yolanda, Kevin, Arjun, Daniel, George and Tom on their NEON wins.

Out NEON +$.73 ~ Yolanda E.

Out NEON +9%, thanks JB. ~ Kevin E.

In Neon at 3.20 out 3.87… Biggest win for me till date.. Thank u JB. ~ Arjun G.

JB, Thanks for NEON. I stopped out at +6.3% last night. ~ Daniel R.

Thanks for NEON +12% ~ George B.

Out neon +$3,000, thx, JB! ~ Tom L.

JOIN NOW for Jason Bond’s real time buy and sell alerts!!!

The portfolio looks solid. OREX approval was delayed 3-months for further review which should be good for ARNA. YGE is a longer term swing I plan to add size too and YOD has the potential to run between $3.60 and the low $4’s into the weekend.

Video: Tuesday’s daily wrap covering NEON, YOD. I plan to put together a video lesson on the NEON trade today too.

The Russell 2000 ran into some resistance Tuesday which is to be expected after the big move to the upside it had recently and U.S. futures are pointing to a lower open Wednesday. I think the overall trend in the market is up now so any pullbacks to higher lows are buying opportunities.

Here’s Wednesday’s watch list.

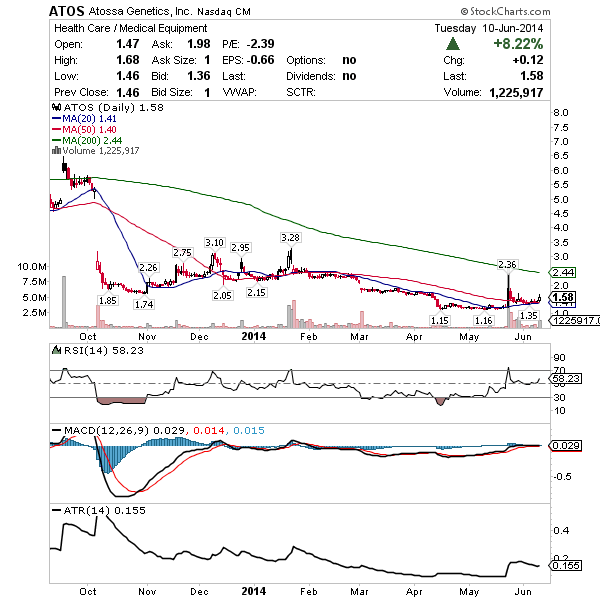

ATOS – A ‘poison pill’ provision sent shares of Atossa flying recently. Now on the curl with range to $1.80’s followed by the 200 Moving Average I like this trade above the MA(20) and MA(50) stacked at $1.41 and $1.40 respectively. The company will still consider takeovers and the provision could command a nice premium keeping shorts on their toes.

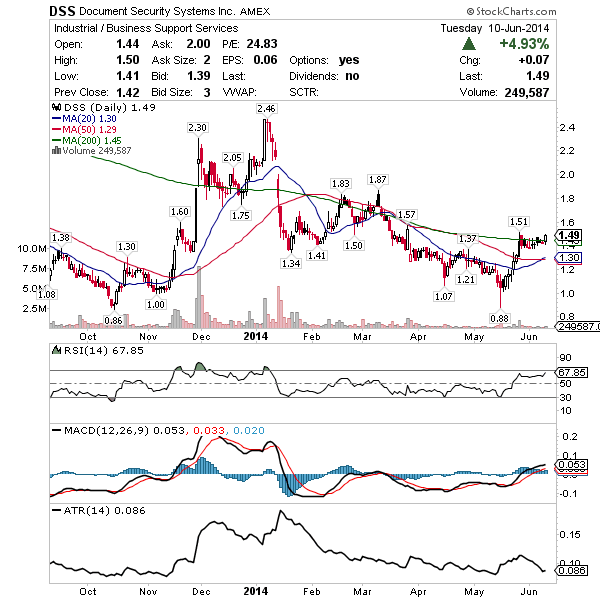

DSS – Exact same chart as CTIC, YOD both of which are making moves to the upside. This is a continuation pattern and it has range into the $1.80’s. Watch for entry above the MA(200) which has been acting as support. Tuesday’s +5% move out of consolidation could be the start of a juicy jump.

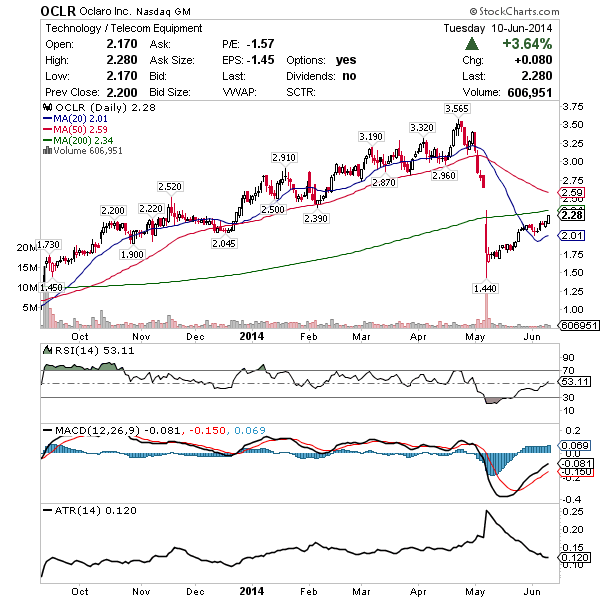

OCLR – Relative strength and momentum favor a move into May’s gap down. Missed earnings and poor guidance knocked shares down but outside the initial panic selling buyers have seen this as an opportunity accumulating the one steady uptrending stock. Tuesday’s 4% break out of consolidation could be a sign a bigger stick is looming into the gap.

Jason, you had an interesting article on SA about positive things in Florda as it relates to TRTC—my question to you—how do you currently feel about this company moving forward and why? Thanks Charles

look at $ITI