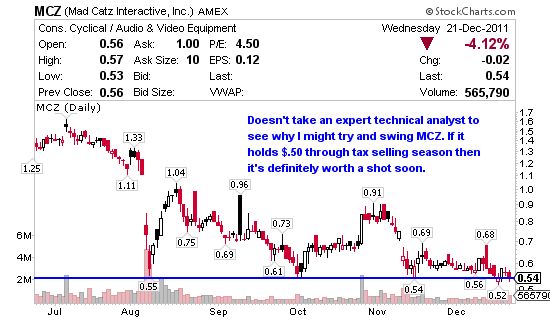

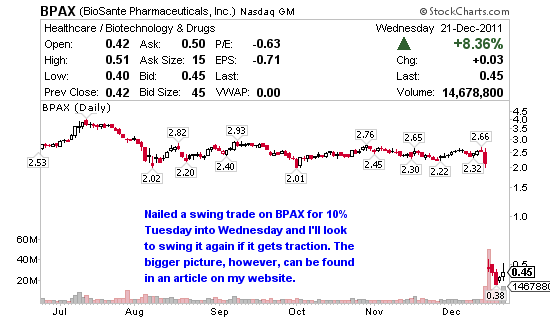

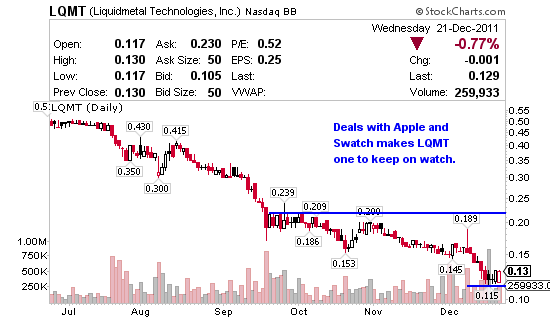

I’ve traded all of these stocks; MCZ, EK, BPAX, LQMT and THQI in 2011, most of which were successful swings. I don’t expect most of these stocks to make moves until the tax selling season is over, however, keeping them on watch and making technical trades could work before 2012 and / or start your year right because several are poised to bounce and several are buyout candidates.

Mat Catz Interactive (AMEX:MCZ) designs, manufactures, markets, sells, and distributes accessories for videogame platforms and personal computers, as well as for iPod and other audio devices. Technically I’m watching MCZ off $.50 support but don’t expect this one to move until January due to soft guidance by the company.

Eastman Kodak (NYSE:EK) provides imaging technology products and services to the photographic and graphic communications markets worldwide. Question here is between bankruptcy and patent sales. Clearly EK needs to make some moves and I wouldn’t be shocked to start seeing headlines again very soon. The only technical bottom we have to work with is from back in September when they hired bankruptcy attorneys and the price plummeted to $.54 before bouncing.

BioSante Pharmaceuticals (NASDAQ:BPAX) a specialty pharmaceutical company, develops products for female sexual health and oncology. Tuesday I bought and alerted BPAX at $.42 as a swing trade on the technical bounce. Wednesday I took my 10% as a part of the 20% plus move the stock made. I still see potential in BPAX so I will scout for another entry. You can see exactly what I’m looking for in January if you check this article I wrote the day BPAX collapsed.

Liquidmetal Technologies (OTCBB:LQMT) develops, manufactures, and sells products and components made from bulk amorphous alloys worldwide. LQMT’s deal with Apple and Swatch make keeping it on watch worth your while but there have not been many good trading opportunities in the last year. In addition volume is light so you won’t be able to position with as much size here.

THQ (NASDAQ:THQI) develops, publishes, and distributes interactive entertainment software for various game systems, personal computers, wireless devices, and the Internet. I’m one for two trading THQI recently but looking at the bigger picture I think we could see the stock turn in 2012. Having said that there might not be a lot of good technical swings between here and there if it can’t hold $.72 support before January. If it turns off $.80 here I’ll consider a swing but with $.90 resistance just ahead they’ll need to be a catalyst to drive it through there.

0 Comments