The 2019 trading year is coming to a close, and most traders are taking it easy, spending time with their family and friends to ring in the new decade… instead of staring at the screens all day.

Sure, we can talk about stocks and the market… but with low trading volume expected this entire week, I believe we can use that time for better purposes.

Instead, I want to provide you with the necessary tools to help you achieve your goals come 2020. Maybe you want to improve your odds of success or make more money… or master a new strategy.

Whatever the case may be, there are a few ways to set yourself up for success — techniques that you could use starting tomorrow to jump start your trading come January 2.

Clearly Defined Position Sizes

Many eager traders will just throw down random bet sizes, without a care. However, if you want to protect your trading account, one simple tip — make sure you have a clearly defined position size.

You can do a set share or contract size, or use a set dollar amount. What I mean by that is you can set a maximum for how much you’re placing on any given trade.

For example, let’s say you’re comfortable trading 300 shares or 3 options contracts. That means you should stick to that number, regardless of whether you think a trade is really juicy.

You could also set a maximum dollar amount for your position sizes. For example, you can set your bet sizes to say $1,000 per position. That means on any given trade, the amount of capital you put in should not exceed $1K.

Practice Your Scales

When you’re actually entering trades, you need to properly execute. Rather than slamming into your max position size, you can actually scale into your trades. In other words, you could slowly build a position until you hit your max size.

Moreover, when exiting trades, you could scale out. You see, when you’re holding onto winners, it doesn’t make sense to just get out of your position all at once.

You could sell a portion at different prices, coupled with trailing stop orders (these orders help to protect you from giving back all your profits when you’re up in a position) could maximize profits.

Clearly Defined Edge for Every Single Trade

I realized the hard way that following your gut doesn’t always work to your favor. The “I feel like this stock could go up” days have been over for me for a while.

For me to consider a trade, my patterns need to be there, otherwise, I won’t be in the trade. Now, there’s no use to saying this out loud…we’re traders and there needs to be some accountability.

If you really want to stick to this rule, you could journal and document all of your trades. A notebook works well if you’re old school, or you could use Google Docs, Microsoft Word, or Evernote to store all your pertinent trade information.

This journal would include screenshots for entries and exits, and the explanation of the trade setup and for the exit. Now, you shouldn’t just journal your trades and forget about them… reviewing your trades every day would help me with your trading psychology and be more patient.

Focus on A+ Trade Setups

If you really want to be a successful trader, you have to focus on your best setups. There’s no reason to place a trade unless you have a clear edge.

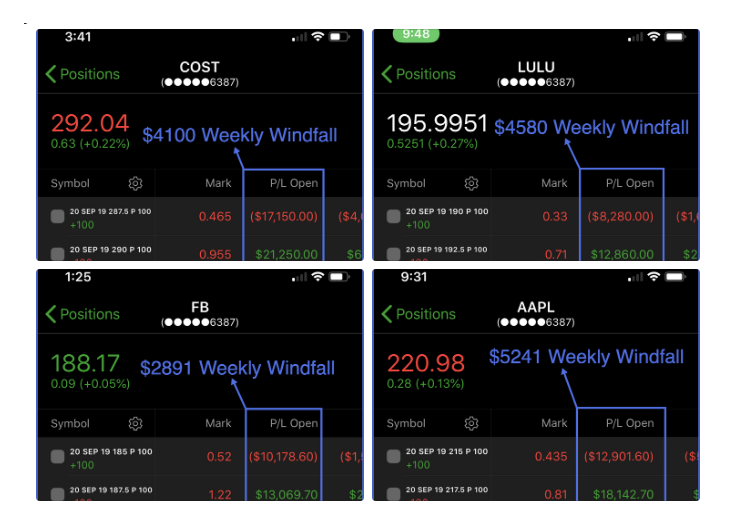

For example, one of my best strategies is actually focused on options, I call it Weekly Windfalls.

Why do I consider this an A+ strategy?

Well, there are three ways to profit. Not only that, but my risk is defined and I know exactly what my max profit will be. That allows me to plan my trades and schedule my profits… there are no surprises with this strategy when it comes to how much you could make or lose.

Not only that, but it allows you to profit off directional moves in stocks… and the only thing you need to do is look for a key level, one where you think the stock has a high probability to stay above or below.

My Weekly Windfalls strategy has allowed me to trade some of the largest companies and uncover massive profits in 2019.

Come 2020, I’ll still be focused on this strategy… and I think it’s one that could take you to the next level and reach your profit goals, as well as improve your win rate.

Since we’re heading into a new year and decade, I’ve dropped the price of my Weekly Windfalls service by 60-70%. Once you get the hang of it, you’ll be able to take advantage of the tips I outlined above… and it could very well take you to the next level.

Click here to take advantage of this exclusive deal before it’s too late.

0 Comments