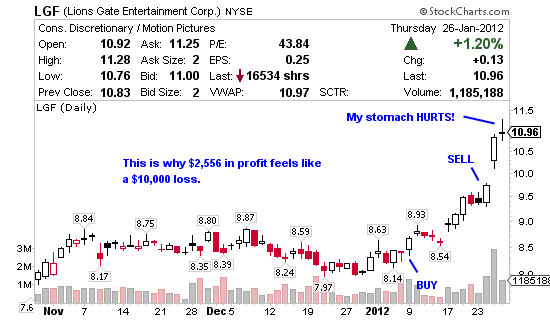

On the 9th of January I alerted my first 2,000 share entry on LGF long around $8.45. I added 2,000 shares to my position the next day around $8.80 during the technical breakout. This trade was labeled a long term position on the account of The Hunger Games movie in March. My plan the whole time was to hold through all the ups and downs. Then in a stroke of genius, on Tuesday January 24th I had a gut feeling the market was going to pull back so I sold my position at $9.31 for a legitimate 7.45% profit or $2,556… great right!?

Well not so fast! Immediately after selling the stock took off, gaped up to $10 and today hit $11.28. That’s literally less than 2 days later and about $10,000 in profits on the table because I had a hunch the market was overbought haha. At the moment of selling, I figured I’d lock in a nice profit and just buy back at $9 support a few days later #fail!!! This is painful to write about but a good lesson for all of us… if you find a great catalyst with a strong technical pattern then just stick with your game plan. The Hunger Games movie launch in March was one of the best catalysts I’ve found in a long, long time… so it’s very frustrating that I let broke my plan so easily. That my friend is how $2,556 in profit feels like a $10,000 loss.

Hey Jason,

I’m surprised to see this post. I was just watching your vid the other day where you described your move to profit.ly — and I noticed in your clip about the subscriber area that you were in LGF and that you were holding this bad boy for awhile. I’m in at 9.01 so I mentally high fived you. LOL And yeah, you high fived back.

But you gotta love those gut feelings. Sometimes they work out, sometimes not. The awesome part is that you put up a post about it. Transparency. That’s what it’s all about. A real life trade lesson is sometimes better than the would be gain. At least to your subscribers.

Keep up the good work. No doubt you killed it this month already anyway.

David John Hall

Hi David. High five is right and many thanks, I appreciate you saying so. I couldn’t bring myself to write about it yesterday but knew I just needed to get it off my chest so I forced myself to do it this afternoon. Now I feel like I can put it behind me but I won’t forget the lesson. Please keep in touch, appreciate you writing in.

why didn’t you use a trailing stop??

Just felt strongly the market was coming down.

I appreciate you writing about this because if anything it shows me that you are cautious. If I want to ride it higher that’s on me, you have subscribers to look out for. I like it. Signing up for you in March and can’t wait!!!

Thanks Kevin, look forward to having you with us.