Good morning.

For the fourth week running and two more record highs of the DJIA and S&P 500, stocks got a boost from another week of global “risk-off” trading. At the close Friday, the DJIA, SP 500 and NASDAQ rose 0.29%, 0.61% and 1.40%, respectively, catalyzed by concerns of the central banks of European Central Bank (ECB) and Bank of Japan (BOJ) won’t be as active accelerating the expansion of their balance sheets.

With U.S. debt yielding as much as 150 basis points more than Japanese and German bonds, money flowing into U.S.-dollar denominated securities may continue until the gap between U.S. rates and German/Japanese rates is significantly closed, providing an updraft to large-cap stock with competitive dividend yields to U.S. Treasuries.

Just take a look at the dividend yields of the 30 largest U.S. stocks (DJIA), here, and you’ll see why more clearly why a risk-off trade includes the purchase of higher-yielding U.S. stocks. Does anyone fear Coca-Cola not paying its 3.05% dividend each year? Coca-Cola’s balance sheet looks a lot better than Treasury’s balance sheet. Doesn’t it? And the yield on your money is better, too. As long as the Fed demonstrates it has control over interest rates, the DJIA may be just fine.

In the short term, however, the VIX concerns me. With a close of 12.02 this week, the extreme complacency of such a low reading causes me to hesitate participating in this market in any meaningful way until we witness some froth taken out of the market and a higher VIX.

We need to remember that the VIX has averaged 19.5, using five years of data as a parameter. You’ll notice in the second-half of this LT Report (my trading activity) I’m trading lightly and cautiously. As I have stated in previous editions of this report, patience is most virtuous aspect of trading, and it took me years of experience to draw from this wisdom.

A synopsis of my sentiments of the market may be gleaned by reading the following short article posted this week by zerohedge.com: The Market’s Biggest Permabull Is “Scared About The Month Of August”.

Because fears of two central bank heads in Europe and Japan altering their rhetoric to one of monetary restraint, the strength of the U.S. dollar spilled over into the precious metals market, which was looking for an excuse anyway to consolidate and flush out momentum traders after a huge rally since the Brexit vote in late June. While the U.S. Dollar Index crashed through its 50-week moving average to the bullish side, to settle at 97.52 this week, gold and silver prices dropped 1.07% and 2.99%, respectively.

Weakness in the commodities markets confirms the the breadth of the rush back into the U.S. dollar this week. The price of West Texas Intermediate Crude (WTIC) dropped sharply by 4.52% to close at $44.19 per barrel, while the Commodities Research Bureau Index (CRB) slumped by a hefty 3.15%.

And in the bond market, the U.S. 10-year Treasury got a small lift from the strong U.S. dollar, closing at a yield of 1.57%, down from 1.60% at the close of the previous week’s trading. Note: rising bond prices results in lower yields, indicating demand for cash, a risk-off trade. The spread between the 10-year and two-year Treasury dropped three basis points as well, to settle at 86 basis points on Friday, as this suggests further Fed tightening from December’s rate hike may flatten the yield curve more. The Fed doesn’t want that; I assure you.

Allow me to put it this way: why would the Fed raise rates when global traders believe the economic outlook in the U.S. isn’t rosy, and therefore aren’t inclined to park capital in productive assets? It makes no sense, of course, unless my belief the Fed is playing a game of pretend is spot on! I firmly believe rates won’t rise in the coming months, especially not before the presidential election in November.

In the meantime, I remain “cool as cat.” For foreign subscribers, “cool as cat” is an Americanism, which means “calm and relaxed.” Election years are typically good for stocks, but with a VIX at 12.06, I’m playing it “cool.”

And we’ll close this week’s market wrap with an answer to a question I’ve been asked often and recently by subscribers.

Q: Jason, you’ve been holding back aggressive trades during the past couple of weeks. What gives?

A: Caution. Trading is my profession, not a hobby or thrill-seeking activity. When the deck is not stacked in my favor, I don’t play. And right now, I see conflicting action in the bond, precious metals, commodities, currencies and stock markets. Something doesn’t feel right.

Be patient and stick with me, and I’ll guide you through a process you’ll come across again and again as you mature as traders. Actually, this period of abstinence is as important to your trading repertoire as picking stocks and timing of your bids and asks. I hope this makes sense, and staying cool until something breaks is my advice. And something will break! Wait for it.

This Week’s JBP Stock Ideas

I reported in an LT Alert on Friday, I sold my stake in ProShares Ultra VIX Short-Term Futures (UVXY) on the same day, at a loss. As I’ve covered this subject in the first-half of the this report, the market makes no sense from a point of view of normal ebb and flow of money. As soon as I felt swimming against the tide, I bailed.

In retrospect, the lesson learned from the UVXY trade can be summed up with: don’t underestimate the dollar’s relative attractiveness during periods of elevated global instability.

Fannie Mae (FNMA)

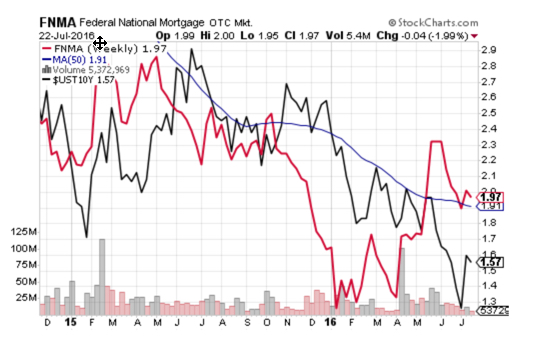

I’m still long 10,000 shares of Fannie Mae at $2.03. I noticed this week FNMA’s continued resilience at the 50-week moving average at $1.91. The chart, below, shows bids come in FNMA at that level.

Notice, too, how the U.S. Treasury 10-year note and FNMA move relatively close together, but the two have diverged since April (FNMA is now trending up, while the 10-year yield is trending down), at which time lawyers for Federal Housing Finance Agency (FHFA) admitted Fannie Mae’s foreknowledge of rapid and substantial earnings projected in fiscal 2013 and beyond, prior to the Sept. 17, 2012 announcement of intentions by the FHFA to grant U.S. Treasury a “full-income sweep” of future earnings derived by Fannie Mae’s business. As a result, traders began piling into FNMA with a sense of a growing possibility of justice actually being served in the future for FNMA shareholders.

FNMA is a stock I’m planning to own for months or years due to the unusual circumstances of the trade. As I’ve outlined in previous editions of the LT Report, investors await a ruling by the U.S. Court of Appeals regarding legal issues stemming from actions taken by FHFA to deny shareholders dividend payments issued by Fannie Mae.

If I’m correct about the FNMA trade, I may stand to make a 10-bagger. A couple of hedge fund managers, include Bill Ackman of Pershing Square Capital Management, who own the stock with the have already suggested even higher capital returns. Ackman values FNMA between $40 and $50. Wow.

Glu Mobile (GLUU)

I’ve previously stated I like GLUU because of its very low valuation when compared with the valuations assessed by the market for Zynga (ZNGA) and Electronic Arts Inc. (EA). The stock’s Price-to-Sales (P/S) of 1.40 is quite a depressed metric for GLUU when compared with ZNGA’s P/S of 3.26 and EA’s P/S of 5.26. GLUU barely trades above Book Value (Price-to-Book of 1.09), with half of the value held in cash of $160 million.

Euronav NV (EURN)

EURN closed up $0.07 this week to trade at $8.85.

07/08/2016 LT Report (partially edited): Headquartered in Antwerp, Belgium, Euronav NV, together with its subsidiaries, owns, operates, and manages a fleet of vessels for the ocean transportation and storage of crude oil and petroleum products worldwide. The company operates through two segments, Tankers; and Floating Production, Storage, and Offloading Operations. As of March 24, 2016, it owned and operated a fleet of 55 vessels, including 30 very large crude carriers, one ultra large crude carrier, 22 Suezmax vessels, and two floating, storage, and offloading vessels.

WHY I LIKE THE STOCK

As I stated in my email Alert of Jul. 15, there are multiple catalysts that may elicit a strong bid for EURN, including a bounce higher in the price of crude oil, a positive global economic report, or a rally in the U.S. dollar against the euro to name a few obvious ones.

Because EURN is a foreign stocks, priced in euros, there are a few things you should know about foreign stocks priced in other currencies besides the U.S. dollar. Before the market opens in New York, EURN first trades in Europe in euros, on the Euronext Brussels.

If, for example, EURN gains 0.30 euro on Euronext, arbitrageurs will take EURN on the NYSE up $0.33 (0.30 euro times 1.10). If, after a period time, EURN closes unchanged, but the euro drops to 1.02 against the U.S. dollar, arbitrageurs will take EURN higher by $0.08 per share due to the new exchange rate of the euro against the U.S. dollar.

Because I’ve been on record as a U.S. dollar bull, the latest political crisis brought about by the Brexit vote (encouraging other countries to leave?) and jitters regarding Deutsche Bank (DB), Societe Generale and a several Italian Banks, such as Veneto Banca, Vicenza, Atlante and Unicredit may advantage U.S. dollar investors, just as U.S. investors of British stocks fared well during the pound’s double-digit decline against the U.S. Dollar following the Brexit vote.

And as a last rationale: I may even get some help with a prospective trade from the Euronav, itself. See my source document here.

The news release states:

ANTWERP, Belgium, 1 July 2016 – Euronav NV (NYSE: EURN & Euronext: EURN) (“Euronav” or the “Company”) today announces that the Company has purchased 192,415 of its own shares on Euronext Brussels for an aggregate price of EUR 1,528,211.

Date Quantity Avg. price Low price High price Total price

24 June 2016 75,270 7.8714 EUR 7.714 EUR 8.000 EUR 592,480.28 EUR

27 June 2016 117,145 7.9878 EUR 7.960 EUR 8.000 EUR 935,730.83 EUR

Following these transactions, the Company now owns 1,042,415 own shares (0.65% of the total outstanding shares).

Euronav may continue to buy back its own shares opportunistically. The extent to which it does and the timing of these purchases, will depend upon a variety of factors, including market conditions, regulatory requirements and other corporate considerations.

Take note of the highest price paid for EURN by the company during the share buybacks of June 24 and 27. Eight euros. With the exchange rate on Friday of 1.10 U.S. dollars per euro, Euronav paid no more than $8.80 per share on these two dates.

I view this news release as an indication of the company’s desire to support the stock below the 8 euro ($8.80) level. Since the company reported 140 million euro ($154 million) as of March 31, it’s likely the company may again support the stock at below 8 euro ($8.80) in the event of another pullback in the stock. The news release may also embolden traders to buy shares of EURN at $8.80.

But, we all know this game isn’t new, of course; we’ve all witnessed share buyback programs and “safe” supports all along the basket of S&P 500 stocks. And now, Euronav has entered the share-buyback game.

Trade Green!

Jason Bond

0 Comments