Happy St. Patrick’s Day! Friday the market gapped down but traded sideways suggesting once again there were buyers on the dip. Monday’s economic data is limited showing the home builders’ index at 10 a.m. EST, Tuesday is light too with housing starts at 8 a.m. EST. But it won’t be quiet all week with all eyes on the FOMC announcement Wednesday. Let’s keep our eye on gold stocks this week, probably another NUGT trade coming ahead of stimulus easing speculation.

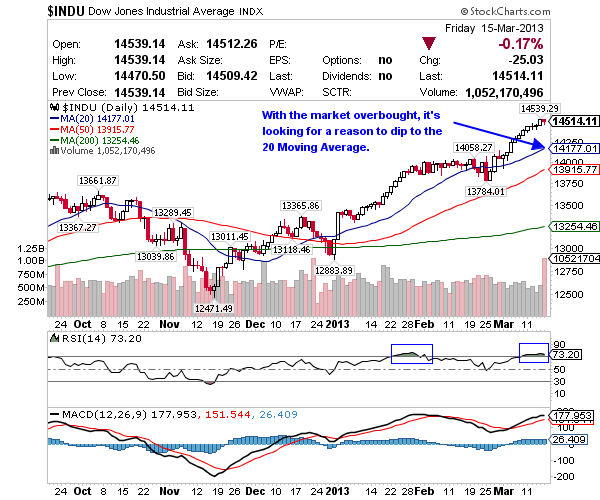

Currently Asian markets and U.S. index futures are sharply lower Monday amid global jitters over Cyprus’s plan to impose a levy on bank deposits as part of its bailout program. There were buyers on Friday’s dip so let’s see how this shapes up overnight and into the open. With the Dow Jones and S&P overbought this could be the trigger for a pullback to the 20 Moving Average.

Special Offer – 30 Day Trial – Limited Enrollment

——————————————————–

THE DAILY WATCH LIST

——————————————————–

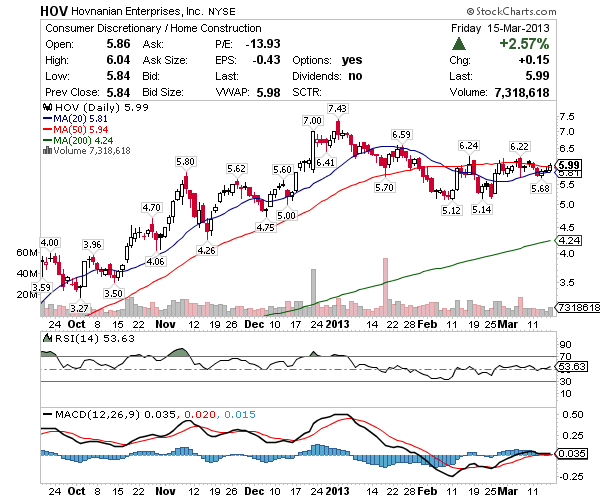

HOV – With housing data Monday and Tuesday I think we’ll see Hovnanian test the $6.20’s again and chop in the $6.60’s. If the housing market continues to improve which I anticipate it will, especially if the FOMC commits to keeping rates low, it’s a possible a test of $7.43 is coming.

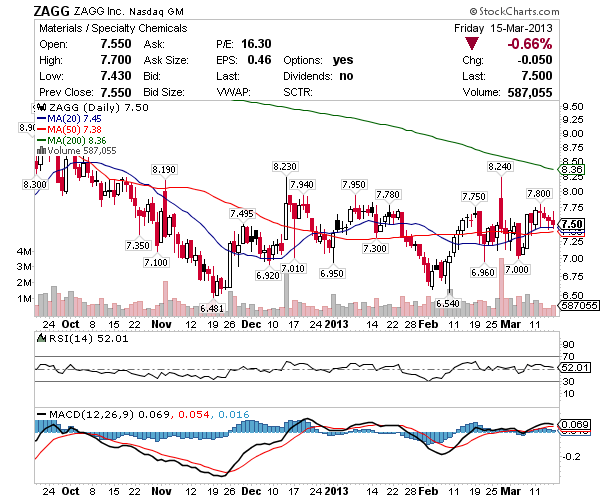

ZAGG – I’ve been tracking this company for a long time and I feel strongly that a move to $10 is coming. I’m a buyer off the 20 or 50 Moving Average this week which is $7.45 and $7.38 respectively. I’m pretty good at predicting news and have a feeling good news will lift this trade soon. Earnings winner too, so bidders are likely to walk it up.

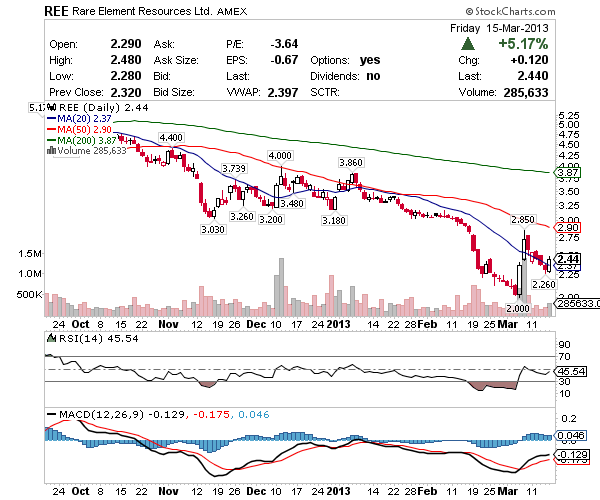

REE – Light volume trade but I like the chart a lot above the 20 Moving Average of $2.37, swing to the 50 Moving Average of $2.90 where it slowed on the last bounce. I also like MCP to head higher, another rare earth play which you can read about in the swing trade stalker.

Special Offer – 30 Day Trial – Limited Enrollment

——————————————————–

THE SWING TRADE STALKER

——————————————————–

Oversold – SKUL, CECO, FLOW, AKS, CEDC (Charts)

Monday – SKUL is on short squeeze watch above $5.06 is in play and there appear to be buyers above $5.20 so let’s start by watching for a curl early this week, 30% of the float is short here. CECO is carried over from last week’s oversold list and appears to be setting up for a move to $3, chop and settle at $3.20’s. FLOW pulled on earnings but they did okay so I’m looking for the stock to settle and I’ll take this trade, despite the low volume, the 200 Moving Average followed by $3.36 are my current markers. AKS candle over candle confirmation Friday, this is in play above $3.46 with chop at $3.77, $3.88 with a goal at the 50 Moving Average just above $4. CEDC is a wild card i.e. buyer beware but honestly given the bull market there’s not a lot of good stocks oversold so I’m just watching the stock for news it’s not pricing for bankruptcy.

Continuation – OCZ, MWW, REE, VRNG, MCP (Charts)

Monday – OCZ is a stock I think is going above $3 soon on a short squeeze so I’ll probably look to get in this week if it curls off the 50 Moving Average candle over candle at $1.93. MWW above the 20 Moving Average of $5.21 is in play this week for a move to $5.50’s and chop followed by a push to $6. REE light volume trade but I like the chart a lot above the 20 Moving Average of $2.37, swing to the 50 Moving Average of $2.90 where it slowed on the last bounce. VRNG is pending court news so like CEDC this isn’t for the faint of heart but you guys and gals know me, I like some speculation from time to time so I’m watching above $2.83. MCP to $7 is reasonable given last week’s news so watch $6.33 as the pivot and I think it’ll settle in the low $7’s.

Breakout – HOV, KEG, MITK, GRPN, ZAGG (Charts)

Monday – HOV is in play with housing data Monday and Tuesday… I think we’ll see Hovnanian test the $6.20’s again and chop in the $6.60’s. If the housing market continues to improve which I anticipate it will, especially if the FOMC commits to keeping rates low, it’s a possible a test of $7.43 is coming. KEG is gearing up above the 20 Moving Average with $9.55 ahead before resistance, followed by a breakout… check out the MACD, nice setup for a push right?! MITK is hugging the 20 Moving Average just off that $5 breakout, keep this pattern on watch because this triangle is close to the apex. GRPN if the $5.50’s break then it’s into the low $6’s and as hard as this is to believe I truly think it’s going to breakout and cover the gap from back in August, CEO out has renewed confidence in this $3.55b company. ZAGG I’ve been tracking for a long time and I feel strongly that a move to $10 is coming. I’m a buyer off the 20 or 50 Moving Average this week which is $7.45 and $7.38 respectively. I’m pretty good at predicting news and have a feeling good news will lift this trade soon. Earnings winner too, so bidders are likely to walk it up.

——————————————————–

VIDEO – Monday March 18, 2013

——————————————————–

0 Comments