Shares of Rite Aid Corp. (RAD) dropped 36 cents (-5.1%) to $6.69 Monday on news of famed hedge fund manager David Einhorn’s sale of RAD during the last quarter.

With volume reaching more than a quarter-of-a-billion-dollars, weak-handed investors couldn’t wait to exit the stock on the news, possibly creating a wonderful opportunity for those traders who seek to enter RAD’s compelling post-turnaround growth story.

First, A Word About Einhorn and Other Hedge Fund Managers

Before we reiterate our bullish thesis for further price gains yet to come for RAD, traders must empathize with Einhorn’s role as head of Green Light Capital and his firm’s stake in RAD.

Einhorn’s deployment of billions of dollars of investor funds is much like a sea captain maneuvering a mega-tonnage freighter; it requires lots of maneuver space, incremental navigation and time.

Though Einhorn’s position in RAD was relatively small when compared with his billions of dollars of available cash, exiting $150 million-plus worth of stock takes time and incremental sales to unwind a position.

And with the Securities and Exchange Commission (SEC) 13F filings released several months after the fact, traders following the trades of Einhorn and his peers could actually do harm to their portfolios, not enhance them.

As a wonderful example of this, consider Einhorn’s sale of Microsoft (MSFT) during the second quarter of 2013, the same quarter he purchased Rite Aid. The chart, below, illustrates how sometimes the news of trading activities of an investment “guru” can help you – that is: by taking the opposite side of the news.

Do we claim that RAD is now oversold like MSFT was in Aug. 2013? No. But the point is: Einhorn’s objectives and the news of his transactions many times create opportunities in and of themselves. In the case of MSFT, buying on the news turned out to be quite a nicely-timed trade in the stock.

Einhorn is among many examples of high-profile hedge fund managers creating trading opportunities for others not burdened with large amounts of capital.

RAD’s Price-to-Sales & PEG Ratio Scream of Outrage

For those not up to speed on Jason’s commentary of Rite Aid, please refer to his analysis of Jun. 6, titled, Rite Aid’s Bull Run Grounded By Fundamentals. Jason delineates his macro analysis of Rite Aid’s business model. The remainder of this article touches upon the addendum to Jason’s previous work on RAD.

Along with Rite Aid’s fundamentals, that include its position to profit from an aging U.S. population, the advent of the Affordable Car Act (ACA), the explosion of high-margin generic drug precipitated by the so-call “patent cliff”, the company’s new wellness program, and management’s response to a breakdown of the company’s competitive advantage, we feel the stock’s valuation does not yet reflect a meaningful shift in the retailer’s risk/reward profile.

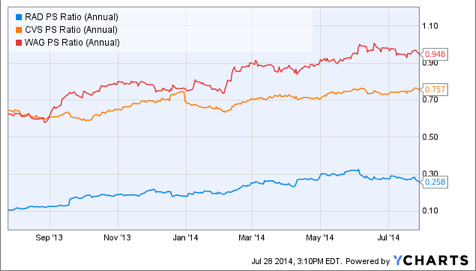

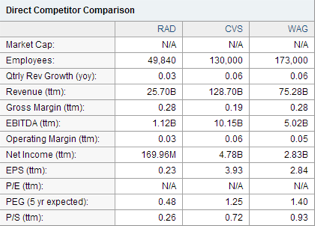

The chart, below, provides a snapshot of the discrepancy we see between the financial metrics of RAD when compared with its competitors, CVS (CVS) and Walgreen (WAG).

Note the two metrics which Jason believes hammers home the point of his bullish thesis for RAD.

Price-to-Sales

Why would a business such as Rite Aid – that expects to increase gross margin at a much more rapid rate than its competitors – trade at a Price-to-Sales (P/S) of only 0.26, when CVS (P/S = 0.76) and WAG (P/S = 0.95) won’t benefit nearly as much from the upcoming patent cliff of brand-name drugs? There is no known material reason, in our opinion, for this most draconian valuation trichotomy (for more on this, see our Jun. 6 article).

Another metric that caught our eye is the large discrepancy between RAD’s Price-to-Earnings Growth Rate (PEG) and that of its competitors. RAD’s PEG of 0.48 suggests that in the coming five year, Rite Aid’s earnings are expected to outstrip the stock’s trend line by a 2:1 margin! Contrast that estimate with CVS’s and WAG’s PEG ratios or 1.25 and 1.40, respectively.

It’s true that RAD’s EBITDA lags CVS and WAG, but how long will that last when Rite Aid begins to report the effects to EBITDA (therefore net income) from higher levels of high-margin generic drugs sales to a growing customer base of aging baby boomers?

Jason’s Takeaway

Nothing in a material way has changed our expectations of further growth in the share price of Rite Aid. The news of Green Light Capital hedge fund manager David Einhorn selling his small stake in RAD may have facilitated a temporary discount to the RAD market price.

The fundamentals of the pharmacy industry remain well-supported for comparatively rapid growth.

We see no compelling reason to expect a negative outcome to Rite Aid management’s strategic plan to resume earnings growth at this time.

When compared with its competitors, CVS and Walgreen, we believe RAD is grossly undervalued on the basis of potential gross margin expansion, Price-to-Sales and Price-to-Earnings Growth Rates (five-year expected).

Looking for another big stock idea like RAD?

To get a heads-up on other stocks we feel may better your rate of profit, start by joining our mailing list (top of the page). Or, take the next bold step now by joining Jason’s community of dynamic and active traders with your subscription to Jason Bond Picks.

Click here for 2013 Swing Trade Performance Record +77% +$238,830.

0 Comments