Shares of headphone maker Skullcandy Inc. (NASDAQ: SKUL) have edged higher in trading Wednesday amid talks that the company maybe a takeover target.

Sharp Decline in Shares Makes Skullcandy an Attractive Takeover Target

Skullcandy shares are gaining after Bloomberg said in a report that the sharp decline in the stock in the past 18 months has made the company an attractive takeover target. SKUL shares have fallen sharply since the company completed its IPO in July 2011. The stock has fallen nearly 64% since its IPO amid concerns over increasing competition and the company’s strategy to focus on lower-margin designs.

According to Bloomberg, Skullcandy has performed worse than all but seven of 185 IPOs completed in the U.S. since July 2011.

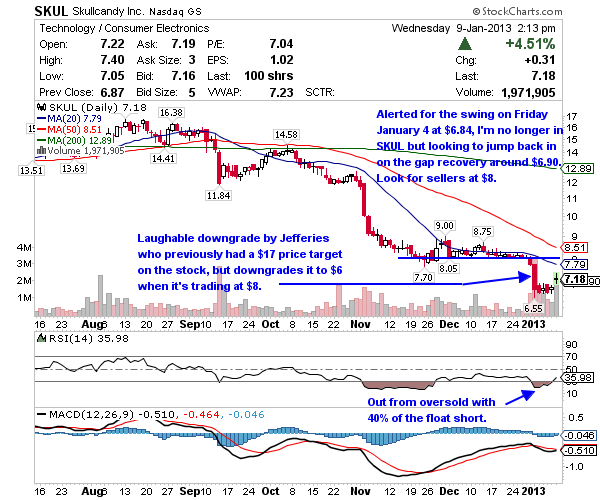

Last week, the stock fell to a low of $6.70 after a rating downgrade from Jefferies. The brokerage firm downgraded SKUL from a Buy to an Underperform rating. In a research note to clients, Jefferies analyst Randal Konik said that he has become increasingly concerned about promotional pressures and rising competition in the headphone market and that the in-ear segment, which comprises over 60% of Skullcandy’s total revenue is under substantial pressure from several competitors.

However, Bloomberg believes that the company’s extremely low valuation makes it a takeover target. According to data compiled by Bloomberg, SKUL’s enterprise value of 3.9 times earnings before interest, taxes, depreciation and amortization (EBITDA) is below 96% of the stocks in the Russell 2000 Index.

Speaking to Bloomberg, David King, analyst at Roth Capital Partners LLC, said that he doesn’t get the sense that management is wanting or would look to sell at these levels, but you cannot ignore that as being a possible outcome when the stock is trading where it is and the value being as cheap as it is. King believes that despite the pressure on SKUL’s business, shares have fallen too far and that could spur a deal.

What Caused the Sell-Off

Back in April 2012, Skullcandy shares were trading above $17. In fact, as recently as August, the stock had been trading above $16. So what has caused the sell-off in Skullcandy shares? A number of reasons, including increasing competition, slower growth prospects and the company’s shift toward lower-margin products.

Back in September 2012, SKUL shares tumbled after technology giant Apple Inc. (NASDAQ: AAPL) announced new earphones. The sell-off was exacerbated by a rating downgrade from Morgan Stanley analyst Jay Sole. Sole noted in his report that Beats Electronics LLC’s brand, Beats by Dr. Dre, was taking more market share than expected. Sole also said in his report that key SKUL product ASPs are falling unexpectedly and he expects greater impact from rivals.

SKUL shares extended their losses in November after the company lowered its 2012 earnings outlook due to a shift toward lower-margin products, escalating U.S. promotional environment and cautiousness regarding the retail environment in Europe. The company lowered its profit outlook for 2012 to $1-$1.04 per share from $1.10-$1.20 per share.

Meanwhile, there are also concerns over the company’s growth prospects.

Despite all these problems, some analysts and investors think that SKUL shares have fallen way too much.

So Who Might be Interested in Skullcandy?

James Harvey, a money manager at Royce & Associates LLC, which holds SKUL shares, told Bloomberg that the other headphone makers may be interested in acquiring Skullcandy. Harvey said that SKUL’s brand may appeal to buyers such as Bose Corp. or Sony Corp.

Harvey noted that Bose, which is engaged in the production of audio equipment, may find SKUL’s brand recognition and low valuation attractive. In a phone interview to Bloomberg, Harvey further said that SKUL generates cash flow and cash flow has been increasing. He added that Sony could also see SKUL as a fit.

Harvey’s thoughts are echoed by Roth Capital analyst King, who believes that an electronic manufacturer looking to enter the headphones market might be interested in Skullcandy.

However, these are just speculation at the moment. Neither Skullcandy, nor any of the companies mentioned in the Bloomberg report has given any indication regarding a takeover. Still, SKUL’s valuation may spark some interest. And this makes SKUL an interesting play in the near-term.

0 Comments