One question I get asked a lot goes something like:

Have you ever missed an entry or a trade altogether…then only to see that stock surge higher…higher…and higher.

I hear you, it’s hard not to think that with all these names – AMC, GME, CLOV, MEDS to name a few… – that seem to just keep going up!

And each time you pull up the chart, you get the painful tickly feeling inside, thinking of the money you left on the table?

At last, you decide to pull the trigger… and that exact moment it all comes crashing down!

Next thing you know, your position is negative, and with every new red candle, you wish you had sold earlier.

The suffering becomes unbearable. You bite the bullet and cut the loss… only to see the price bounce quickly!

If that sounds familiar – well, I’m not going to blame you.

Today I’m going to share with you some of the most valuable lessons I’ve learned to help control FOMO.

What is FOMO?

FOMO stands for Fear Of Missing Out.

It applies to many areas outside trading, and I don’t have to explain what this means – we’ve all been there, done that.

As traders, especially beginners – FOMO-driven decision-making has happened and happens to most, if not all, of us.

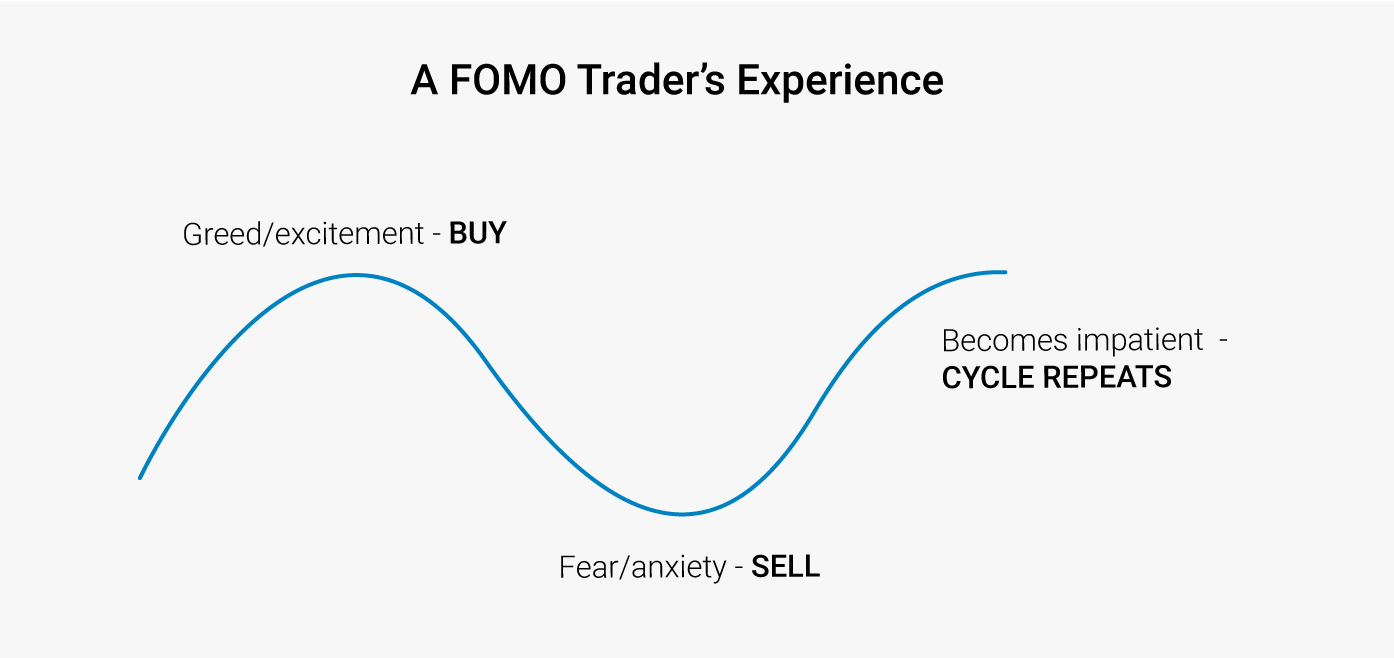

Here’s one image I saw a few days back that perfectly summarizes the vicious circle:

Source: DailyFX

Fear and Greed are the two dominant emotions behind most of our financial decisions.

Keeping them in check is naturally hard, and the consequences of losing control are never pleasant.

The good news is – it doesn’t have to stay this way.

Much like anything else, this is a skill you can master, and let me teach you how.

Why Am I In a Trade?

Simple question, right?

If answered honestly, though, this becomes your most powerful tool in fighting FOMO.

Let me give you an example – here’s my 3D Systems (DDD) trade from mid-May:

I was getting long between $20-$20.50 against $18 with a target right below $30.

So, Why Was I In This Trade? Here’s the reasoning I’ve put out:

- The stock is in a pretty hot sector

- It has moved higher on a positive news catalyst.

- It’s been beaten down, might finally be breaking a technical downtrend on large volume, and crawling back above long-term support turned resistance.

- The short interest is high and will supplement an up move.

- I clearly defined risk with a stop ~$18 and plenty of room with a target of around $30, giving me a favorable 1/5 risk/reward.

In my world, that’s a worthy trade to take!

Now you ask yourself, why are you in a stock you’re in? Can you list the specifics?

- Are you in it because it’s going up and social media are buzzing about it?

- Did you only buy because you heard a loud mouth say it’s the next big thing?

Consider this: would you enter now, if you weren’t in the trade already?

If any of these questions plant the seed of a doubt – chances are you’re trading out of FOMO and this isn’t a trade you should be in.

Being honest about your reasoning will make you money, but more importantly – will save you money.

Speaking of which…

Not Losing Is Winning

I can only speak for myself, but it’s safe to say most traders can name many trades they wish they never took.

It’s one thing when risk is calculated, and the trade didn’t work out – these trades are just the cost of doing business.

I’m talking about irrational entries, trades you should’ve never made in the first place.

Trades that fall into the latter category of the section above.

Look, I get it. We’re all human… You can’t be a robot 100% of the time.

But next time you’re rushing to smash the Buy or Sell button, pause for just a split second and think – What if it doesn’t work? Is this a responsible risk to take?

Even when your big picture idea is correct but you’re rushing an entry – more often than not this isn’t the best trade to take.

Forcing yourself to stay away will save you lots of distress and lots more money!

Consistency is the name of this game, and limiting the unnecessary drawdowns is the best you can strive for.

And this brings me to:

Don’t Set Perfectionist Targets!

Look, the best basketball team doesn’t win every game and the strongest army won’t defeat every single enemy.

Greatness in any craft is the net total result.

Don’t set targets that will make you force your trades. Forcing a trade is begging for trouble!

You can’t be green every single day and don’t beat yourself for it.

The job is not to be perfect but to maintain a healthy proportion of winning vs losing.

Don’t make trading harder than it has to be and don’t put yourself in a position you can’t think straight.

0 Comments