You’ll need an account at Interactive Brokers, Wedbush or SureTrader to bang out short trades on most stocks under $10. This isn’t part of my core strategy so don’t worry if you don’t have accounts at any of those places… this list is simply for my guys and gals who do. Personally, I might fund my Interactive Brokers account to hit up some of these cupcake trades more often but probably not until the summer rolls around. If I see an excellent short opportunity, I’ll be sure to send an alert, even if I’m not jumping in the trade.

You’ll need an account at Interactive Brokers, Wedbush or SureTrader to bang out short trades on most stocks under $10. This isn’t part of my core strategy so don’t worry if you don’t have accounts at any of those places… this list is simply for my guys and gals who do. Personally, I might fund my Interactive Brokers account to hit up some of these cupcake trades more often but probably not until the summer rolls around. If I see an excellent short opportunity, I’ll be sure to send an alert, even if I’m not jumping in the trade.

Keep in mind, I hardly ever hold real small caps overnight because it’s a great way to blow up your account should the company announce big news like a buyout come morning, which happens to small caps a lot and it only takes once to do big damage.

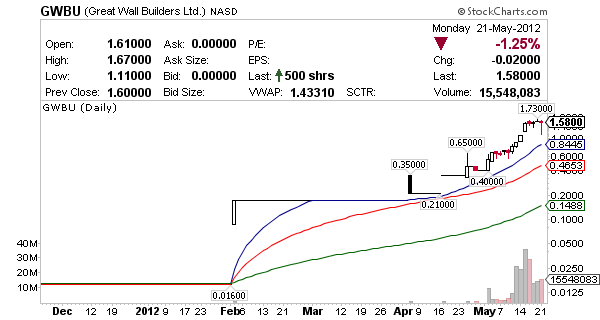

GWBU flushed today from $1.67 to $1.11 or 34% in about 45 minutes before it snapped back up and trended higher into the close. I’ve been trading pump and dumps a long time, volatile action like this up top often suggest a bigger dump is right around the corner. Careful though, these guys pull the bids on purpose to flush out weak hands and trap shorts, tomorrow we’ll find out if it works, key to $1.65 resistance area because that’s where it’ll squeeze if it does. No shares at Interactive Brokers.

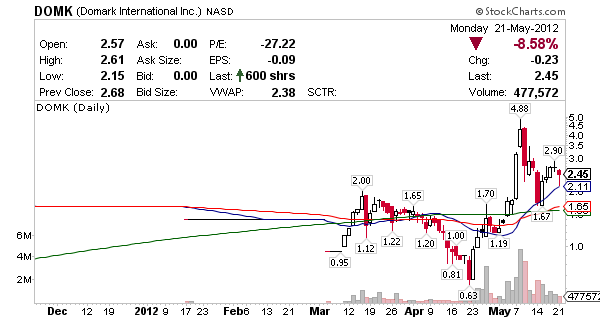

DOMK also flushed early from $2.61 down to $2.15 in the first 30 minutes or 18% before snapping back up. Key $2.22 support Tuesday, if that goes there’s a good chance this one’s on it’s way down to that $1.60 range, problem is it’s already heavily shorted. No shares at Interactive Brokers.

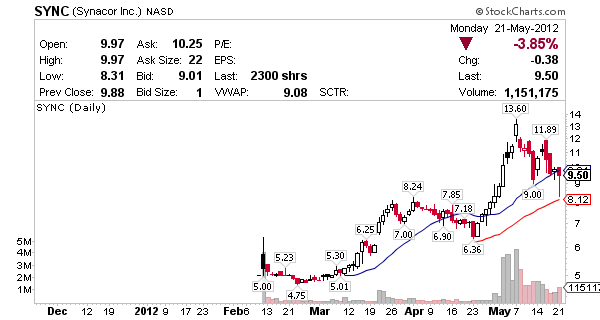

SYNC makes it 3/3 on the short list today, if you could find shares at any of the 3 brokers listed above there was big money to be made. SYNC went from $9.97 down to $8.31 around 1 p.m. EST before working off the bottom or 17% intraday, not bad if you ask me… might need to open that Wedbush account again. NIA is actively pumping away but if they don’t start to move this thing up soon there’s a chance it’ll fall apart on them, in my mind the $9 range is the new pivot point. No shares at Interactive Brokers.

0 Comments